Recently, I had the pleasure of speaking at the FinTwit Summit 2021. If you didn’t attend, it consisted of 16 speakers presenting on a variety of investing topics over the course of March 20-21, 2021. My talk was entitled “Ask your Developer… For your Next Investment Idea”. It focused on the premise that developers are key to enabling the digital transformation we all hear about and increasingly have influence over software purchase decisions. By observing how developers evaluate the software providers that cater to them, investors can gain signals to pick the probable winners in the software tooling and infrastructure space. Many of these providers are publicly traded companies.

As I had dedicated the last couple of weeks preparing for that talk, I wanted to share my take-aways in a blog post. For those who didn’t have a chance to attend the Summit, you can still register and get access to all the recorded sessions. This post will explore the points I made in more detail and share how I am positioning my portfolio for the year. This is grounded in the trends I continue to see for the companies providing the building blocks for developers to deliver the next wave of digital experiences.

Background

The title of my talk was inspired by Jeff Lawson’s new book “Ask your Developer”. If you aren’t familiar with Jeff, he is the founder and CEO of Twilio (TWLO). In the book, Jeff discusses the trends around building new software applications to enable digital transformation and how developers are at the center of that effort. He provides a playbook for enterprises to better engage their developer organizations in order to ensure they can create the most innovative customer experiences. If you haven’t read the book, I recommend it. You will get insight into how Jeff thinks about building Twilio and how they view their relationship with customers.

Every industry is turning digital and every company needs the best software to win the hearts and minds of customers. The landscape has shifted from the classic build vs. buy question, to one of build vs. die.

Jeff Lawson, CEO Twilio

One of the key points that Jeff makes is how enterprises need to differentiate themselves from competitors. In a new world in which digital transformation is forcing every company to build innovative experiences online, customers will evaluate their relationship with each company based on the quality of their digital interaction. To compete, enterprises can no longer purchase one-size-fits-all, off-the-shelf software packages to deliver services, but must create unique online experiences catered to the specific needs of their customers. That means becoming a software company, and more specifically a software development company.

To underscore this point, Jeff shifted the common business phrase of build vs. buy, to build vs. die. This emphasizes the need for enterprises to distinguish themselves from competitors by creating unique customer experiences. Otherwise, their solution will function just like all the other offerings on the market and limit their ability to develop a unique relationship with their customer. This mirrors past business efforts in the physical world to curate the store’s environment and amplify in-person customer service operations. The same highly customized experiences will be duplicated in digital channels.

The task of building the applications that deliver these digital experiences falls to software developers. Developers create these experiences from many common software components, ranging from open source and commercial packages to APIs. A lot of these software components are provided by commercial entities. Some are even publicly traded companies, which means investors can participate in this trend through a pick-and-shovel approach.

While investing in the building blocks of digital transformation makes sense, the average investor still needs to determine which picks and which shovels are best. As the builders of these new experiences, developers are the ones influencing purchase decisions. Software providers that best align with developers and internalize a developer mindset stand to garner the most attention and developer adoption. This translates into sales of products and services, and ultimately generates revenue.

The best software providers exhibit certain behaviors in their relationship to developers, their approach to the software ecosystem and the operation of their companies. These behaviors can be observed and provide signals for investors to select the stocks to add to their portfolio.

Digital Channel Investment

To help set a foundation for investment in digital channels, Twilio recently published their State of Customer Engagement Report. It highlighted many of the trends behind digital transformation and expectations for better customer service and convenience going forward. The findings were gathered from two sources. First, Twilio observed actual customer activity on their platform over the course of the year. Twilio has reported 221k active customers, so this casts a pretty wide net. Additionally, they surveyed over 2,500 enterprise decision-makers to understand what observed trends could be considered permanent. Survey respondents were full-time employees of companies with 500 to 25,000+ employees, from the director to executive level.

Twilio discovered that the vast majority of companies accelerated their digital transformation by years as a result of COVID. With that said, they think this demand will continue after COVID clears. After being forced to utilize digital channels, most consumers have realized that it is more efficient to perform many of their daily tasks online. Going forward, they will expect to have digital channels available from every company selling them a good or providing a service.

As a simple exercise, think about what percentage of your daily activities can be serviced by engagement with a digital channel today versus 5-10 years ago. We have digital options for shopping, health care, education, financial management and many more. There is no longer a need to go to a physical location to accomplish a task unless you really want that experience. Almost any “mundane” interaction can be performed more efficiently online. While people will be anxious to re-engage in social activities after COVID clears, they will still utilize the more efficient digital channel for mechanical tasks like shopping. In fact, the time savings gained by not driving around to shop will likely fuel incremental consumption of other activities, both offline and online.

Also, it is also worth considering that there were a host of industries which had a digital component, but couldn’t be utilized during COVID, like travel and hospitality. Twilio, for example, had customer segments that were impacted by COVID. As it clears, we can expect this utilization to return and incrementally rely more heavily on automation. As an example, there are already some hotels that don’t require a physical check-in. All interactions end-to-end are automated through the hotel’s app including room reservation, starting the rental, accessing the room, ordering food, requesting services and finally checking out. All of these new touch points performed through digital channels rather than physical ones increased the software utilization footprint of the hotel chain by an order of magnitude.

Looking forward, I think two additional forces will drive a continued rapid expansion of the digital map. First, AI and ML, combined with huge data sets, will allow applications to be even more proactive in the future. Systems will become smarter and anticipate what consumers need. They will make intelligent recommendations and we will entrust them to automate more of our daily lives. These prompts will be served through software applications, requiring more consumption of software building blocks and services.

Second, IoT will expand the surface area for software input and output. As devices of all types are allocated compute, sensors, output interfaces and network connectivity, the number of applications and data services to interact with them will explode. The data these devices collect will need to be processed, stored and acted upon. Instructions for devices to take actions will be calculated, ordered and communicated. All of this will generate additional utilization of software applications and underlying infrastructure.

If we buy into the need for digital transformation and the benefits of more automation and smart devices, then we have to understand what enterprises require in order to deliver it. At the core, this is software. As customers expect more convenience, personalization and time savings, enterprises will need to up the ante of their customer service applications.

Creating these automated experiences has never been more accessible to the enterprise. We have recently reached a powerful convergence of connected devices, readily available software infrastructure and programmability that hasn’t existed in the past. It easier now than ever before to rapidly assemble new software applications from open source packages, third-party APIs and some custom code. Applications are pushed to public cloud infrastructure through automated CI/CD pipelines and store data in practically infinitely scalable data stores.

This rush to create new software experiences is dependent on the work of developers. They are at the heart of a company’s ability to compete in the future, not salespeople or physical store designers. This puts developers in a new position of influence within their companies. And just like the employees who had the latitude to work with preferred vendors for offline experiences, developers have significant influence over selection of software building blocks and services.

Examples of Digital Transformation

Before we delve into the criteria developers typically use to evaluate software providers, let’s briefly look at some examples of real-world digital transformation. Restaurants are about as mundane an industry as you have, and have traditionally been an in-person experience, even up to just a few years ago. However, most chains are rapidly innovating their ordering experiences to make them available online. Granted, the impetus for this was to remove physical interaction as part of COVID-induced social distancing, but the efficiency of online ordering seems to be sticking.

For many restaurants, COVID forced them to rethink the ordering and pick-up process, in order to minimize personal interaction. Prior to COVID, many acknowledged that online ordering could represent a new engagement channel, but few supported it. Some innovators, like Starbucks, demonstrated that a holistic online ordering and loyalty program can create significant time savings (skip the line) and incentives for consumers. Yet, most restaurants were still behind the curve, and de-prioritized investments in digital channels.

As we know, COVID necessarily accelerated the adoption of these channels and restaurants have built better relationships with their customers in the process. Consumers get convenience and discounts. Restaurants gain repeat customers, rich behavioral data and operational efficiency. They need less space and fewer frontline employees. These benefits will ensure that digital interactions remain and likely incentivize restaurant chains to invest further to make the consumer experience smarter and easier.

As an example, Chipotle now anticipates up to half of all sales to occur online. Even after COVID, they expect this to persist as customers value the time savings and convenience of just picking up their food in the store versus standing in line to order it. Chipotle even recently started rolling out digital-only kitchens in heavily populated areas, which completely removes the human dependency.

Taking that a step further, Chipotle just announced an investment in Nuro, which provides a fleet of on-road, autonomous vehicles to deliver everyday consumer goods. They plan to utilize the service to add more delivery options to food ordering.

Expanding access and convenience through Chipotle’s digital ecosystem is a strategic priority for the company. Chipotle’s digital business grew over 174% year over year in 2020, with about half of the digital sales coming from delivery. Early investments in digital innovation have provided a competitive advantage operationally with digital kitchens and the brand’s Chipotlanes. Now the organization is exploring disruptive opportunities outside of traditional third-party partnerships.

“We are always seeking opportunities that provide innovative solutions for increasing access and convenience for our guests,” said Curt Garner, Chief Technology Officer. “Nuro could change the traditional delivery model and we believe consumers are going to continue to seek options and additional access points for how and where they enjoy their food.”

Chipotle press release, March 2021

In addition to building software applications to facilitate ordering, now they are addressing the other end of acquiring food by offering automated delivery. This process will require additional digital interactions, like designating pick-up points, setting the route, notifying customers when their food arrives and providing feedback.

I think it is constructive to consider the ramifications of this. First, as pointed out above, these customer interactions are all done through digital channels, requiring software applications dedicated to loyalty programs, ordering, tracking the order, delivery and notifications. More importantly, the time spent by the consumer previously acquiring food was all offline – they traveled to the restaurant, ordered in person, waited for their food and then traveled back to origin. Very little of this process involved digital channels. The consumer now has additional time to spend elsewhere, a portion of which will likely be on other digital experiences.

Other chains are building online experiences as well, like Panara, Starbucks, McDonalds, Chick-fil-A, Chili’s, etc. In all cases, these chains are assembling their ordering web site and mobile apps using a custom application development stack, based on software components and services from open source projects, hyperscalers and many independent software providers. Both the Chipotle web site and mobile app were built in-house using agile methodologies and a custom tech stack hosted on Microsoft Azure. Other major chains have built custom apps as well to provide their customers with unique experiences.

Grocery chains are going through a similar process. During COVID, many expanded online grocery ordering and delivery. They also partnered with third-party grocery delivery services, like Instacart and Shipt, to jumpstart their offerings. However, many are now acknowledging the same benefit that restaurant chains experienced. By owning the digital experience, they can offer more value to their customers and compete for more share of wallet.

A recent example is the announcement of a multi-year partnership between Albertsons and Google Cloud to “reinvent the future of grocery shopping”. Albertsons is one of the largest grocery chains in the U.S. encompassing more than 20 grocery brands—including Albertsons, Safeway, Acme, Tom Thumb and Randalls.

The partnership will leverage technologies from Google Cloud to make grocery shopping easier and more convenient, available across multiple digital channels. Planned innovations under the partnership include shop-able maps with dynamic hyperlocal features, AI-powered conversational commerce and predictive grocery list building. They bill these initiatives as sustained post-pandemic transformation to improve the consumer experience both near and long term.

Through this partnership, we’re looking to transform the grocery shopping experience far beyond the pandemic. For example, AI-powered hyperlocal information and features will make it easier to get your grocery shopping done—enabling things like personalized service, easier ordering, pickup and delivery, predictive shopping carts, and more.

Google Cloud / Albertsons press release, March 2021

This provides a concrete example of the point I raised earlier. I think porting offline experiences online is only stage one of what is broadly being called digital transformation. Enterprises are realizing that AI and large data sets can spawn whole new services that are more intelligent, personalized and convenient for the customer. These go far beyond moving ordering to a web site. They all require more software infrastructure to deliver the UI, communications, data processing, storage and monitoring. Additionally, after Albertsons rolls out services like this, other grocery chains will be compelled to do the same.

Beyond restaurants and retail, whole new market segments are being created online that didn’t exist previously. These aren’t examples of a long-tail transformation from offline to online, but represent the creation of new software-driven experiences from scratch. Collaborative fitness apps like Peloton, virtual health care and branch-less financial services all provide examples.

Roblox and other gaming companies have seen a surge in activity during COVID. Roblox is the most popular global online entertainment platform for kids and teens with over 150M MAUs. They have created a community with 4M developers who have produced over 40M games. Many user experiences beyond gaming, like education, are moving into these virtual environments as well. The Roblox Monetization team maintains a virtual marketplace that handles over 4M transactions a day.

Looking forward, more and more of our time will be spent and needs met through digital experiences. Think about Peloton – previously one would go to the gym and that was purely an offline experience. Maybe you would swipe a membership card as the only digital interaction. With Peloton and other fitness trackers, all the data associated with your ride, interactions and communications have to be serviced by software. Peloton is a big customer for many of the independent software providers that I will discuss, while traditional gyms were not. Even if a large portion of the population returns to physical gyms, I suspect they will want to bring their digital tracking and channels with them. As an example, Peloton bikes are popping up in hospitality and community fitness rooms.

For Roblox and other gaming platforms, they built their digital worlds on top of custom application stacks. In many cases, they pulled in software building blocks from outside providers. Examples include Elasticsearch (ESTC), MongoDB (MDB), JFrog (FROG), Redis, Cloudflare (NET), HashiCorp and CockroachDB. As utilization of these new digital experiences increases, so to will revenues for these providers. Plus, time savings from automation of one’s daily tasks, like shopping, can be allocated towards gaming and online worlds.

Pick-and-Shovel Play

As investors, we can position our portfolios to capitalize on these trends revolving around the expansion of digital channel usage. One option would be to select the best providers of end user solutions, whether that is Chipotle for restaurants, Farfetch for retail, Peloton for fitness or Roblox for gaming. Many investors have been successful with this approach by leaning into leaders in each category. Another strategy is to pursue a pick-and-shovel play. By examining which commercial software providers seem to be popular with the developers building these digital experiences, investors can assemble a basket of stocks in companies that should see demand aggregated across all industries.

Pick-And-Shovel Play

An investment strategy that invests in the underlying technology needed to produce a good or service instead of in the final output. It is a way to invest in an industry without having to endure the risks of the market for the final product.

INvestopedia

This strategy of investing in the building blocks of an industry is referred to as a pick-and-shovel play. The term originated from the observation that the majority of money made during the California Gold Rush in the 19th century came from selling the equipment needed by gold miners. The key point to this strategy is that investors don’t need to worry about which restaurant chain, gaming platform, specialized retailer or collaborative fitness app will win. They just need to look at the common software building blocks that all these digital experiences will require and invest in those providers.

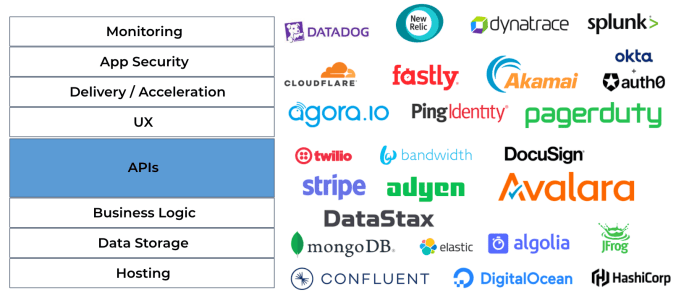

When talking about a strategy of investing in the application development stack, we should first examine the building blocks that are needed. Below is a very simplified view of a typical application stack that illustrates some of the major categories of software services that could be purchased from independent providers. I realize this isn’t representative of every software tool and purposely excludes systems outside of app development, like analytics and enterprise security. I also show the logos of some of the independent software providers in each category. The hyperscalers, like AWS, Azure and GCP, span most of these categories as well.

Much of this common plumbing represents services provided by APIs that can be easily plugged into the application. Usually teams want to write custom code only for the parts of the application that can generate competitive advantage and “outsource” the rest. I highlight APIs in the stack, as that is a huge area by itself. Some of the biggest independent software providers, like Twilio for communications and Stripe for payments, deliver all their services through APIs.

In considering these software components and services, it is often the developers who make the selection. So, appealing to developers is critical to success for these software providers. For each of these layers of the application stack, there are both open source and commercial options. While open source provides a great starting point for development teams, they often find add-on services that they need around the core project which they are willing to pay for. This is the genesis for the open core model that several commercial entities have built around an open source project. MongoDB, Elastic and Confluent are some examples.

Similarly, a lot of services in applications don’t have an open source alternative. These are generally common functions, like payment processing, communications, application and security monitoring, or content delivery acceleration. Many commercial companies provide solutions around these needs. Some of them are publicly traded, with others planning an IPO. This provides us as investors with a list of companies to screen. The next step is figuring which providers are likely to win the most market share.

A Note on Future Technology Development

I realize that this application software stack is representative of the current technology paradigm largely associated with centralized trust, control and storage, often dubbed as Web2. On the horizon are newer Web3 applications, which feature a fully decentralized application runtime that utilizes blockchain-based protocols for data storage and logic enforcement. The Ethereum web site provides a useful primer on the main differences between Web2 and Web3, at least in the context of Ethereum.

Decentralized applications (referred to as dapps) feature back-end code running on a decentralized peer-to-peer network. This contrasts with traditional Web2 apps, in which the back-end generally runs on centralized servers. Due to their decentralized nature, dapps are not controlled by a central authority. This is one of the primary design features, allowing them to be trustless and resistant to censorship. For the UI and front-end rendering of a dapp, developers have more flexibility, often sharing approaches and frameworks similar to existing Web2 apps.

The Ethereum site lists some of the advantages of this approach for application development (copied verbatum).

- Zero downtime – Once the smart contract at the core of an app is deployed and on the blockchain, the network as a whole will always be able to serve clients looking to interact with the contract. Malicious actors therefore cannot launch denial-of-service attacks targeted towards individual dapps.

- Privacy – You don’t need to provide real-world identity to deploy or interact with a dapp.

- Resistance to Censorship – No single entity on the network can block users from submitting transactions, deploying dapps, or reading data from the blockchain.

- Complete Data Integrity – Data stored on the blockchain is immutable and indisputable, thanks to cryptographic primitives. Malicious actors cannot forge transactions or other data that has already been made public.

- Trustless Computation/verifiable behavior – Smart contracts can be analyzed and are guaranteed to execute in predictable ways, without the need to trust a central authority. This is not true in traditional models; for example, when we use online banking systems, we have to trust that financial institutions will not misuse our financial data, tamper with records, or get hacked.

Decentralized apps do have some challenges that developers need to keep in mind. First, application maintenance and fixes are more difficult to manage, as code and data published to the blockchain becomes harder to modify as a consequence of decentralization and the desire for permanence. This constraint raises the bar for application testing in advance of release, in order to suss out as many bugs as possible. This is similar to the care applied in advance of a hardware release or the offline world of shipping software on disks. Publishing code on the blockchain, like in smart contracts, is less accommodative of the rapid release and “fix forward” approach to traditional web app development. A closer parallel model for Web2 app developers would be the process of preparing a mobile app to be published on the Apple App Store.

Second, scalability of transactions is harder to achieve as they have to be duplicated across the network. This by design as every node must run and store every transaction for transparency. This can create network congestion and puts a lot of processing pressure on each node. Many of these issues are being addressed in future versions of blockchain protocols, or iterations of existing ones. For Ethereum, Eth2 promises to make the Ethereum network more scalable, secure and sustainable. This adds sharding as an example, which spreads the network’s load across multiple chains.

In its current state, dapp frameworks and supporting infrastructure don’t address all requirements and use cases found in typical enterprise application development. That said, they are evolving quickly with new service layers wrapping the core blockchain protocol that add capabilities and abstract away both complexity and limitations. More broadly, the philosophy of decentralization will likely create whole new business models that don’t mirror the enterprises making up the current Global 2000.

Even some services that are crypto-related employ software infrastructure from traditional Web2 providers. As an example, the decentralized exchange dYdX utilizes the Ethereum blockchain to record transactions. However, the vast majority of activity on the exchange is stored in the order book and processed by the matching engine. The order book records all the offers to buy or sell a cryptocurrency and the matching engine generates the actual purchase transactions. Due to the type of activity on the exchange (derivatives, options), a subset of all orders actually result in a transaction which is recorded on the blockchain. In an interview on Software Engineering Daily, the founder of dYdX discussed the technology platform behind the exchange in detail. He mentioned that the order book and matching engine, which handle over 99% of the activity on the exchange, are hosted on AWS and utilize PostgreSQL as the data storage engine. The point here is that crypto and blockchain services can still generate sizeable incremental usage for Web2 software providers.

For now, the vast majority of software applications funded by the Global 2000 companies utilize the Web2 paradigm. These will provide a long tail of growth for software providers, as digital transformation, AI and IoT continue to enable new type of digital experiences for consumers and businesses. There is likely a parallel, early stage investment opportunity to identify the future Web3 software component providers and predict mass adoption of blockchain protocols. That isn’t currently within the scope of this blog.

It is worth mentioning that many of the leading Web2 software services providers are monitoring the evolution of Web3 and blockchain-based networks. Similar to their approach in identifying the supporting software building blocks and services for Web2 applications, they will likely consider the same for Web3.

As an example, DocuSign saw an opportunity early on and has built in support for blockchain. In 2015, they worked with Visa to create one of the first public prototypes for a blockchain based smart contract. DocuSign is currently a member of the Enterprise Ethereum Alliance, and in June 2018, announced an integration with the Ethereum blockchain for recording evidence of a DocuSigned agreement.

A similar argument can be made for Cloudflare. Their mission is to “help build a better Internet”. With over 200 PoPs (data center locations) spread across 100 countries, they can generically be considered as a high capacity distributed network. In a recent interview on alphalist.CTO, Cloudflare’s CTO, John Graham-Cumming, described the function of his team as focusing on future technologies and innovation for Cloudflare. As an example of recent work, he mentioned they had been examining the function of Ethereum and blockchain-enabled networks, and what opportunities may exist to align these with Cloudflare’s basket of software services. With their product development momentum, developer centric motion and financial position, it wouldn’t be a stretch to see Cloudflare expand their offerings to address aspects of Web3 software infrastructure and tooling. Many of the advantages of dapps, like isolation, autonomy and data distribution, are characteristics of serverless edge computing.

Interestingly, one of the future directions of optimizing the Ethereum network involves updating the Ethereum Virtual Machine (EVM). One of the proposals that appears to be gaining steam is to migrate the runtime for Ethereum transactions to be based on WebAssembly (WASM). This flavor of virtual machine is being referred to as eWASM, basically Ethereum’s transaction framework based on WebAssembly. eWASM provides several benefits over EVM, including much faster performance and the ability to utilize multiple programming languages for smart contracts.

The reason I find this interesting is that several serverless edge networks utilize WebAssembly as the runtime target. These products include Cloudflare Workers and Fastly’s Compute@Edge. In the case of Fastly, they further optimized the WASM compiler and runtime for extremely high performance, released as the open source project Lucet. Lucet claims to the best performing WASM runtime available. I mention these examples because if Ethereum moves its virtual machine to be WASM based, then software providers like Cloudflare and Fastly may be able to extend their existing WASM tooling to offer services to dapp developers.

Looking more broadly, another possible risk to continued growth of investment in digital channels and demand for transformative software solutions could come from a shift in business priorities. With the U.S. government narrowing attention towards investment in infrastructure and green initiatives, digital transformation might shift to the back burner, or no longer represent a growth area. Selecting the likely winner of electric vehicles or even a pick-and-shovel play for eco-friendly transformation has and will likely continue to reward investors.

However, as it relates to investment in digital transformation, I would argue that infrastructure and green projects would bring increased investment in software automation, IoT and AI along with them. I think the role of ML/AI in autonomous vehicles is clear, but investors could also consider how that might apply to all components of transportation (shipping, trucking, delivery, etc.). Similarly, many aspects of “green” initiatives have a large data collection and processing component. Windmills, hydro-electric, power distribution, etc. all benefit from having their many components connected to a network/grid (i.e. IoT), sensor data collected (data storage and processing), activities coordinated (application processing and communication) and performance optimized (AI/ML).

Even in a mundane industry like construction, new approaches to project management and coordination are being offered by digital native companies like Procore (with an IPO planned). As I have written in a past post, Procore is a major user of software services, including moving all of the typical sub-contractor agreement management onto DocuSign’s platform accessed through APIs. Procore uses many other open source and commercial software components, infrastructure and services to drive their platform.

As another example, the low code platform Appian (APPN) cites the Dallas/Fort Worth International Airport (DFW) as a major customer. DFW used Appian’s low code platform to deliver a number of new software applications ranging from providing flight information for passengers to coordinating various employee functions as part of airport operations. All of these types of applications need compute, data storage, communications, content delivery, etc. An investment in upgrading America’s airports would certainly include this type of automation.

While IT investment from enterprises to move offline experiences to digital channels may level off in the future, I believe that a whole new set of initiatives will further drive the demand for software applications. These will continue to improve automation, convenience and personalization for consumers. As each public and commercial enterprise leapfrogs the other in software capabilities, the laggards will need to invest more to catch up, or risk being left behind.

What are Developers Looking For?

Developers are at the heart of creating innovative experiences for consumers. They are increasingly making software provider purchase decisions. As investors, if we can identify and evaluate what developers are looking for in software solutions, then we can find indicators of those providers who will likely gain the most share of a particular market segment.

We believe every company is a software company, and every company is building applications to deliver better experiences to their customers. We empower the software developers who are creating these applications to innovate faster by removing the complexity from identity and making it simple, extensible and customizable.

EUGENIO PACE, CEO AUTHo

Auth0 is an identity and authentication management service, primarily accessed through APIs, which will be acquired by Okta. They make it very easy for developers to shift the user account creation and login process to Auth0’s highly secure and performant cloud-based service. User login is a common function of almost every consumer application, yet isn’t an area which offers much opportunity for differentiation between enterprises. As such, it represents an ideal software component to outsource to an outside service.

The developers on an enterprise engineering team would evaluate providers of SaaS-based authentication services and decide which one to use for their enterprise application. Their decision to use a provider, like Auth0, or not, has a lot of impact over Auth0’s future revenue streams. According to the CEO of Auth0, developers are looking for simplicity, extensibility and the ability to customize their solutions.

As a starting point, we can examine the discovery process developers typical take to find a provider for an external solution. When building a new software application, the development team will decide which functionality they will deliver through custom code (usually for competitive advantage) and which functions they will outsource. As mentioned previously, good candidates for outsourcing are those common plumbing components that don’t offer a lot of opportunity for differentiation and are easy to support by an outside entity.

Software services that are ideal for outsourcing represent functions that can be serviced through an API integration. Examples include things like payments (Stripe, Adyen), customer communications (Twilio, Bandwidth, Agora), authentication (Auth0/Okta) and agreements (DocuSign, Adobe Sign). It wouldn’t make sense for a development team to choose to build their own SMS distribution or payment processing.

The same argument applies to common software infrastructure components, like hosting, containers, data storage, content delivery and monitoring. A development team wouldn’t write a database from scratch or set up their own CDN, unless they felt they could outperform commercial alternatives or needed to address nuances unique to their application. Only the largest Internet application engineering teams would consider this, due to resource requirements. Often, even if they choose to roll their own, they will eventually fall back to commercial options as they realize the depth of investment required and need to focus on their core business advantage.

Given that developers need to utilize many external providers for various components of their application stack, we should examine how they go about choosing the ones to use. In many cases, they may already have experience with a particular technology, like a database, monitoring service or payment provider. That experience usually designates that provider the default. This motion in itself makes these software providers very sticky and explains their low churn rates and high net expansion.

However, many developers are asked to provision a new service or software component that requires a solution they haven’t encountered previously. For these cases, it is useful to understand how developers generally perform their research to select a new tool. To answer this, Stack Overflow (a popular resource for developers) conducted a survey of developers about how they perform research on new software offerings.

The number one criteria was that they want to try out a provider’s solution before they commit to it. This is a departure from the enterprise sales model of 10-20 years ago, which relied on in-person sales and Powerpoint presentations to the executive team. With instant provisioning of cloud resources and API services, developers can perform real-world experiments using the provider’s solution themselves. Developers have the ability to validate a provider’s solution before they recommend it.

Because of this, providers that enable free trials and instant access to their services are most likely to get attention. Developers are often doing this work at 2am and don’t want to talk to a salesperson first. Therefore, the providers that offer free trials and frictionless onboarding will be included in the evaluation set. Those that throw up roadblocks get pushed to the back. Always being time constrained, if a developer can satisfy their use case with one provider’s solution, they may not loop back on the other provider’s solution that was harder to evaluate.

This developer-centric motion has short-circuited the traditional sales process. It’s pointless for a CTO to view a slide deck or watch a sales presentation, when their developer already has a basic working prototype and can tell them what is and isn’t available. The CTO will eventually engage with the preferred provider’s sales team to negotiate deal terms at scale, but this is normally after a selection has been made, not as the first step.

The second most prevalent criteria for technology selection by developers is getting feedback from peers. This involves either asking other developers or reviewing commentary in developer communities and on third party sites. If a developer is unfamiliar with the providers in a technology area, this is often the first step. The developer may solicit feedback or search for input from peers to narrow down their choices of providers to include in their hands-on evaluation. For a software provider, this peer recommendation then becomes an important part of the marketing funnel. It can also provide useful signals for investors.

Free Trial and Instant Access

Twilio (TWLO) and MongoDB (MDB) provide some good examples of an easy sign-up and onboarding process. In each case, the information required to provision an account is minimal and the developer gets a base level of usage allocated for free. This allows them to perform sufficient experimentation to validate their use case.

Monetization occurs after the developer confirms that a service meets their needs and then upgrades to a paid account. As another example, Pagerduty recently rolled out a free plan which provides basic on-call management and incident response for a DevOps team of five or fewer. This is expected to help broaden the sales funnel, as sign-up and onboarding are automated. As the customer’s team grows and they want access to more functionality, they can easily upgrade to a paid plan.

In the past, offering a free plan with online sign-up was viewed as a lost opportunity for an enterprise software company, by not forcing a discussion with sales or collecting some payment up front. However, in the new world, I think this openness means the provider will be included in more evaluations. And, sales can always follow-up later to see how the developer’s experience was.

This initial developer experimentation is important as it starts building a relationship with the provider and creates inertia for sticking with that provider’s solution. After a developer has invested some time in a solution they like, they tend to stick to it, as there is a sunk learning cost.

Developer Portal

Once the developer signs up for a free account, they want to get productive as quickly as possible. To do this, they will seek out documentation and sample code. This makes the usability of the provider’s developer portal critical. Navigation, content structure and visual appeal must be considered on the same level as with any consumer app. The developer will quickly sense how serious the provider is about catering to the developer community, based on the quality of their developer portal.

As an example, DocuSign refers developers to a dedicated portal to learn about accessing their APIs. It includes full documentation on all APIs, along with sample code, SDKs in six programming languages and Postman test collections. For monitoring the API integration, they also provide dashboards and health monitors. DocuSign began leaning into their developer experience starting two years ago, with the launch of a new Developer Center. That launch followed a doubling of the number of developer sandboxes on their platform from the year prior.

As compared to the developer experience for Adobe Sign, I think DocuSign’s developer portal is more visually appealing, easier to navigate and comprehensive. The impact of this difference in developer portal usability is reflected by the relative amount of product usage driven by APIs between the two offerings, in which DocuSign’s API usage exceeds 60% of all agreements versus Adobe Sign hovering around 40%. API usage is very important for electronic agreements, as larger enterprise customers tend to have the resources to create a direct API integration with their bespoke customer applications, versus inserting the e-signature widget into the UI.

Developer Surveys

Developer surveys provide another source of input for what developers want. I like Stack Overflow’s annual survey of developers. It covers a variety of topics, ranging from popular languages and frameworks to tooling. This year’s survey encompassed 65,000 developers, representing a broad spectrum of input. Their survey includes perspective from professional developers across both large and small organizations.

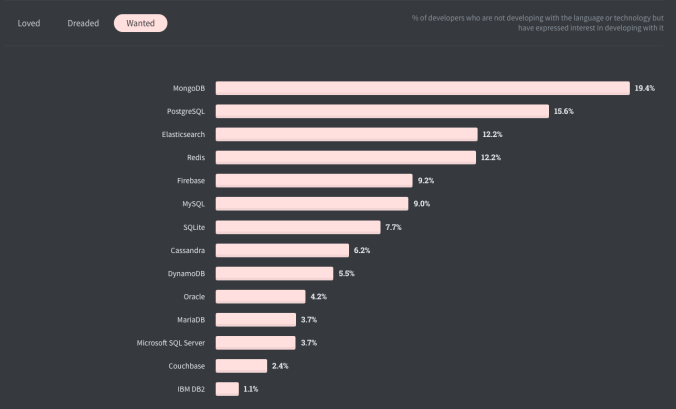

As an example, one category that is insightful is the survey of data storage solutions. They ask developers which database they love to use, dread to use and would like to use. The “Wanted” (would like to use) category provides a signal for future growth potential, as these would be solutions that developers will gravitate towards.

Investors can see that solutions from MongoDB (MDB) and Elastic (ESTC) are high on this ranking. This implies that as developers consider opportunities to apply data storage solutions to new applications (like micro-services as part of an application re-architecture), they may opt for MongoDB or Elasticsearch. Redis is also performing well. The company behind it, Redis Labs, is still private, but may have an IPO in the future. In August 2020, they raised $100M with a valuation just over $1B. The CEO thinks they will be ready to IPO in 1-2 years.

StackShare

Finding evidence of real-world usage of software provider solutions by target customers can generate very rich signals for investors. These indicate expansion opportunities, particularly when the customer companies are considered Internet natives with strong engineering teams. Mainstream enterprises will often emulate the technology choices made by the digital innovators, or they will poach engineering talent. Those developers tend to bring their preferred toolset along and introduce the traditional enterprise to newer options in the software stack.

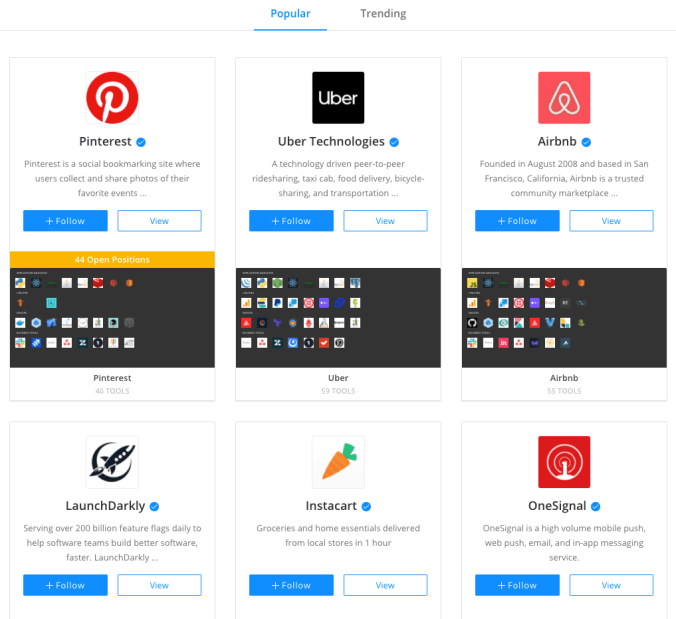

StackShare has been a useful resource for me as an indicator of usage of software providers by large digital natives. Software stack usage is self-reported and encompasses all layers in the stack (as opposed to scrapers like BuiltWith that can’t discern back-end systems). StackShare lists the software components and services used by a particular company and is usually updated by a member of the engineering team.

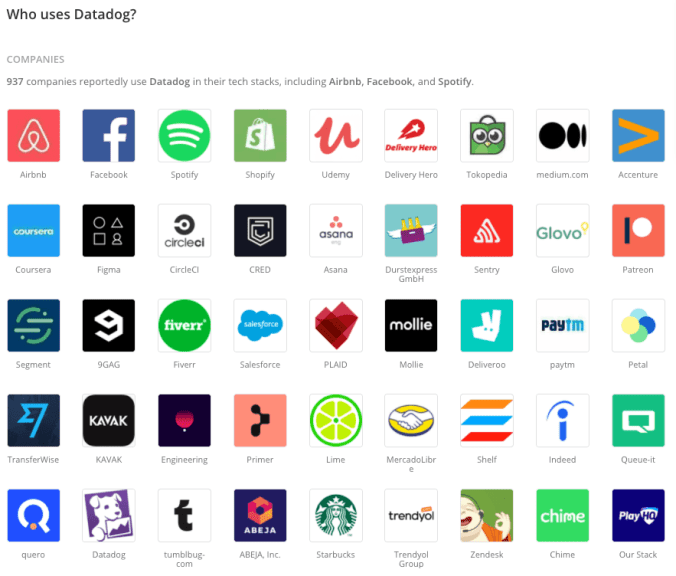

The StackShare interface allows users to view the individual stacks for popular consumer sites. One can also aggregate consumer sites by a particular vendor. For example, the screenshot above shows those sites that listed Datadog as a component of their sofware services stack. Users could then compare a vendor’s usage and penetration to that of competitive solutions. It isn’t a perfect science, but gives users a sense for the types of customers adopting each vendor’s solution.

Job Postings can be another insightful source of usage information. StackShare has relevant job descriptions, but investors can review other job sites as well, like Indeed and ZipRecruiter. I like reading through the job description to see what technologies are required or utilized by the hiring company. Many companies will describe their technology stack as part of the job description and include software skills that are requirements for the job.

In this example, we see that Roku has a job posting that mentions seeking a senior engineer with Datadog experience. If you read the job description, the target product is their ad exchange. That would obviously would represent a lot of usage for Datadog with expansion opportunities over time. While it can be laborious, reviewing the job descriptions for engineers at companies with large operations can provide insight into the tools that they are using.

Community Content

Developer community sites and publications can generate insights into how software provider solutions are trending in popularity. Sometimes, this requires skimming through many posts to find the nuggets. Reddit can be useful, but can also include a lot of noise from opinionated members. I tend to look for threads that appear more objective and data-driven than philosophical.

DB-Engines is a great resource to see trends on data storage technologies. The rankings on that site are based on measured activity aggregated across many social channels: search engine queries (Google), prevalence on developer forums (Stack Overflow), job descriptions (Indeed, Simply Hired), LinkedIn profiles with those skills and Twitter tweets. The absolute ranking is less important than the trending.

As an example, interest in MongoDB has been consistently improving. You can see the increase in popularity both year/year and month/month. Elasticsearch and Redis also continue to demonstrate consistent positive interest. Further down the list, we can see some other developments. Snowflake moved up from position 100 to 30 in the last year. It passed Amazon Redshift (a notable competitor), which has dropped from position 31 to 32, reflecting sustained interest, but not growth.

Podcasts about software development provide another useful source of information. My favorite is Software Engineering Daily. They often have guests who are mid-level managers at provider companies, supplying hints around strategy and execution at a more tactical level. For example, Fastly’s CTO was recently interviewed about serverless. I thought there were some interesting signals in that interview, including the idea that Fastly sees distributed data storage as a bigger opportunity than edge compute or CDN.

Engineering leaders at customer organizations are often guests as well. These interviews provide perspective on the software solutions and services being utilized by the largest Internet operations. Investors can learn about how these leaders are being impacted by digital transformation, the factors driving their business and most importantly how they are addressing new opportunities with software applications.

I realize that combing through Reddit posts and listening to podcasts can be time-consuming, but I do think they provide meaningful context for investors on the software development space. If anything, this kind of background can help you maintain conviction in your companies.

Formal Analyst Comparison Grids

At the other end of the spectrum, formal comparison grids from industry analysts can provide a source of curated information. While developers increasingly influence technology purchase decisions, managers and CTO’s will weigh in as well. These leaders often reference industry reports as part of their research process. Reports from Gartner, Forrester and IDC MarketScape are some examples of recognized sources. Often, I find these to be lagging indicators, so it is important to watch the progression of newer offerings, versus focusing on the relative position of legacy products. Also, consider that some providers prioritize building relationships with the analysts, which may add a little bias. Analysts can favor the status quo and take a while to acknowledge disruption in a category.

Investors can usually access these reports on software vendor sites by going through a short registration. Many providers will promote the reports that show them in a favorable light, as a function of marketing. These reports can be useful for investors to read, both for rankings and for overall context. Oftentimes, the commentary is more revealing than a provider’s actual position in the matrix.

G2 Grid providers a more crowd-sourced ranking from actual users as opposed to paid analysts. With this in mind, it can generate useful insights for SMB / Mid-market targeted products. Because of the sourcing, the individual reviews can be noisy, but also provide more raw feedback than the curated content from paid analysts. Some smaller software providers will try to game the system, getting lots of positive reviews added. This is similar to efforts by companies to get their Glassdoor ratings up, through a concerted effort by the HR department.

Developer Outreach

The quality and breadth of Developer outreach from the software provider is another important indicator of future growth. This is where the disruptive, progressive software providers excel and set themselves apart from legacy vendors and the hyperscalers. They often maintain high quality blogs, supplemented by active social media accounts on networks like Twitter. Some even maintain Discord servers to engender a more focused discussion with developer groups.

The best content shared through outreach is developer-centric, written by engineers or product managers. It is often technical, covering both product releases and general industry trends. Content is updated frequently and not forced. A good indicator of the cadence of product development at a software provider is the flow of blog posts. If you find yourself challenged to keep up with reading all blog posts, that is a good sign.

Cloudflare has probably the best curated blog of the providers I follow. They publish deep coverage of new product releases and a steady stream of insightful updates. It can also be very technical and is personally edited by their CTO (who seems extremely knowledgeable and hands-on). Cloudflare is active on Twitter, with tweets utilized to drive developers to new content. Usually these are blog posts, but also include industry news and special offers.

Another content source worth mentioning specific to Cloudflare is their video streaming channel called Cloudflare TV. This provides a 24/7 schedule of video content with a healthy mix of live and pre-recorded segments. The content covers product releases, deep dives, customer interviews and general industry trends. It is a useful resource to keep appraised of Cloudflare product releases, as they will often inject many live segments during their product release weeks.

YouTube is another great source of signals around trends and activity for software companies. You can watch past presentations from leadership and engineers from provider companies at popular developer conferences, like O’Reilly’s Velocity conferences, QCon or RSA. I think the best sources of information are informal developer meet-ups, where you can find hidden nuggets of insight. These are often unfiltered views of technologies from the perspective of actual users. As an example, WebAssembly SF has been a rich source of information for me on Cloudflare and Fastly, as it relates to edge compute.

To find useful video content on a software provider, you can type the name of your company into YouTube’s search box. You may have to skim through all the “buy this stock” videos, but will eventually find some informative content. Another tactic is to identify the name of the CTO or head of product and try searching for that. I have searched for “Tyler McMullon” who is Fastly’s CTO, and “Artur Bergman”, who was the founder. Other word combinations, like xyz company tech talk or developer conference, may yield good results. Most providers will record their user conferences and make videos available for the public to watch.

Customer Blogs

Most of the Internet native companies maintain engineering blogs. As major employers of software engineers, they use these as a vehicle to attract engineering talent. They want to demonstrate that they are innovative and interesting, where good engineers can go work on hard problems. For investors, these blogs provide another rich source of insight about what software building blocks customer engineering organizations are using in creating their consumer-facing applications.

As an additional incentive for investors, the companies viewed as Internet innovators are often emulated by the engineering teams at the Global 2000. Software development techniques, tooling, frameworks and services utilized by the innovators eventually make their way into the technology teams of mainstream enterprise. Those companies are increasingly employing software engineers to build unique customer experiences and want to demonstrate a stimulating environment for engineering talent in the same way.

This means observing what digital innovators are doing and even hiring software engineers from innovator organizations to seed progressive thinking in their own technology teams. These advanced software engineers will bring the best practices and preferred software provider solutions with them. For that reason, watching the activities of the digital innovators can feed a long tail of adoption for the leading software building block providers.

To locate an innovator’s engineering blog, just search in Google for “company name” engineering blog. As an example, Shopify provides a great engineering blog. The tagline is “Stories from the teams who build and scale Shopify.” What a great source of information to understand the software picks and shovels used by one of the largest players in e-commerce. Granted, not every post will be useful for investors, but scanning through titles can uncover some nuggets.

As an example, Shopify posted an article in December 2020 about how they have incorporated WebAssembly into the core Shopify development platform as a mechanism to allow merchants and partners to create custom extensions. These extensions address business rules or services specific to that partner, which wouldn’t apply to all other Shopify merchants. Partners could previously support this capability through API’s, but that introduced lag and scaling challenges.

With WebAssembly, the partner can write custom code that is compiled into a WebAssembly target and run inline within the Shopify platform. By using WebAssembly in this way, the Shopify team can isolate the partner’s code in its own runtime, ensuring both security and scalability. The partner can write the code in AssemblyScript, which is a variant of JavaScript.

What is most insightful about this announcement is the use of Lucet as the WebAssembly runtime. For investors not familiar with Lucet, it was developed by Fastly and represents the core technology behind their serverless Compute@Edge offering. While Shopify is hosting Lucet on their platform, their choice of Lucet and WebAssembly as the preferred solution to address the problem of supporting partner customization provides a vote of confidence for Fasty’s approach. Shopify could have easily selected an alternative technology, like the V8 Engine. As part of this initiative, they are also planning to invest in the AssemblyScript project, providing additional support for developer tooling.

Other examples of useful engineering blogs are those maintained by Lyft, Uber, Pinterest, Spotify and other popular consumer services. Beyond finding direct mentions of software provider implementations, these blogs serve as general context for investors trying to build background knowledge into the tooling decisions made by target engineering organizations.

Software Provider Signals

After using signals from developers and community content to identify the leading software providers, we can look for certain properties and behaviors that will indicate the sustainability of their advantage over time. Some of the primary factors I examine are leadership, the velocity of product development, the addressable market and investment in R&D.

To make all this work, we have to empower developers. We have more than 10 million developers around the world using Twilio to build the future of customer engagement and we’re going to continue innovating to provide them the tools they need. Our developer ecosystem is one of the long-term competitive advantages for Twilio and we’re going to continue to focus on making them successful.

Jeff lawson, CEO twilio

Leadership

My preference in a software provider is that the company is founder led, and the founder has a technical background. Technical founders that are still in charge have two benefits. First, they understand the problem space. They don’t rely on a translation layer, like product management, to interpret customer feedback or competitive offerings. Second, they tend to attract other developers by building confidence that the engineering organization is competent. I have worked at companies where top developer hires specifically joined because the CEO could code.

Technical founders were usually involved in building the first version of the software solution. Since they were “scratching their own itch”, they have a strong vision for future offerings and a well-refined framework for evaluating new opportunities. While they wouldn’t be expected to maintain involvement in the codebase at this point, that prior grounding keeps them aligned with the product and engineering team for a long time. Plus, they could spot check code commits if they really wanted to – the risk of which keeps the product organization honest.

If the CEO doesn’t have a strict engineering background, I look for innovation and hands-on activity in technology development at a product level. Matthew Prince of Cloudflare is good example of a founder with technology experience. He did take some CS classes in college and contributed to the original Cloudflare codebase. Additionally, before Cloudflare, he founded Unspam Technologies in 2001 and created Project Honey Pot, which was a specialized spam detection system.

Product Development Cadence

Probably most important indicator of continued success is a software provider’s pace of product development. This can be a competitive advantage by itself as execution speed builds moat. Competitors who can’t execute as quickly will lose ground in platform breadth and capabilities comparisons. The software provider should be releasing major new product features quarterly at minimum, with some averaging significant product expansions every month or two.

As an example to emulate, Cloudflare has maintained a blistering product development pace. This was highlighted in the second half of 2020, when they launched multiple product expansions and new offerings over the course of a 5 month period. They are continuing the pace in 2021, with Security Week and more week-long product events planned. In October 2020, Cloudflare held Zero Trust Week. This launched a whole new market segment with the introduction of Cloudflare One. This release, along with Cloudflare for Teams launched earlier in the year, provided Cloudflare with new revenue streams that likely contributed to their outperformance in 2020.

Rapid, early releases can also collect customer feedback quickly that is bundled into a follow-on release. This early feedback prevents unnecessary work on incremental features that might not be valued by customers. It also identifies real-world bottlenecks and scaling issues early, versus waiting much longer and making them harder to address.

Most importantly, product development can drive TAM expansion. While some product releases provide necessary feature additions within existing product offerings, other releases create entirely new product lines that provide an incremental source of revenue. These are the most exciting, as we witnessed with Cloudflare’s introduction of their Zero Trust product suite under the Cloudflare One label.

Large TAM is an important driver for software providers to sustain long term revenue growth. While most providers have less than 10% penetration of their current TAM, expanding the TAM offers another dimension for future growth. This becomes critical as existing markets become saturated and each new customer win is a competitive displacement. Having multiple new product offerings allows high overall revenue growth to aggregate across multiple sales channels.

Cloudflare is executing well along these lines. They are growing revenue at 50% annually on a $500M run rate. They seem to have a well-refined system for continuing to add new customers and extending spend over time. This combination provides plenty of room to expand into their projected $100B TAM and sustain high growth for many years.

Cloudflare also has a thoughtful strategy around free versus paid offerings. Many of their basic services are sold through an initial free plan, with access to more extensive service levels and features on a paid plan. Cloudflare leadership claims they get many of their new product ideas by observing the activity of the free users. Also, free users will QA new features and provide feedback to improve the offering.

Cloudflare maintains a huge ratio of free to paying customers, with about 30 free users for every one paying. While many free users are individuals hosting hobby sites, I imagine that a large portion are commercial entities who will pay eventually. That provides a long tail of new paid customer adds, that may inflect upwards quickly if a new offering drives many customers into paid. In the latest quarter, Cloudflare reported record new paid customer adds.

Cloudflare also measures the success of new offerings by developer engagement. Included in the Q4 earnings report was a metric that over 50k developers wrote and deployed their first Cloudflare Worker. This is more than double the count shared in Q2 and up 85% q/q over Q3. Other examples of software providers with a large body of free versus paid users include MongoDB and Elastic.

Another reliable indicator for investors to watch in software providers is headcount growth. This often correlates with revenue growth and can even be a leading indicator. Heavy investment in R&D spend will drive product development and TAM expansion, allowing the provider to support multiple product categories.

Datadog invested heavily in R&D during 2020, while other companies slowed down spending. R&D spend now exceeds S&M spend, making up about 30% of revenue. The result has been an acceleration of product additions. Datadog now has 10 separate product offerings with their own pricing. Before 2017, they had only one.

This expansion of new product lines by Datadog is driving increased adoption from customers. For Q4 2020, Datadog reported that 72% of customers are using two or more product lines, up from 58% last year. And, 22% of customers are using 4 or more products, up from 10% a year ago. These are significant improvements, when you also consider that Datadog increased the overall number of customers by 35% year/year. Taking that into account, the number of customers using 4 or more products tripled year/year.

Other software providers that added headcount aggressively in 2020 include Twilio and Cloudflare. These two companies have been rapidly expanding their product offerings as well. As another example, Shopify recently announced they are planning to double the size of their engineering team in 2021 by hiring 2,021 new technical roles. While I don’t cover SHOP, I view this as a favorable indicator for Shopify’s future.

Investment Strategy

Bessemer Venture Partners is one of the most successful VC’s with over 200 investments and significant exits like Shopify, Twilio and Pinterest. Recently, they published an annual report called the State of the Cloud for 2021, which highlighted a number of trends for cloud-based companies. It is worth a read by any SaaS investor.

Cloud computing is increasingly consuming software, hardware, and services and is the most exciting mega-trend in technology, making it one of the most compelling themes impacting global GDP over the coming years.

Bessemer Venture Partners, 2021

Bessemer thinks that the mega-trends around digital transformation and cloud computing are just beginning and will play out over the next decade. This expansion was not just a 2020 story. That premise may be hard to imagine after the acceleration we experienced last year in demand for software provider services and the drawdown in valuations we have been experiencing in 2021. However, they still see plenty of room for these secular trends to play out.

I agree with Bessemer’s view. While COVID moved consumers online for many activities, convenience and time savings will keep them on digital channels. Additionally, competitive pressures will force every player in each segment to match the best digital experience available in a continuous cycle of one-upsmanship. And this isn’t just a long tail transformation, where offline experiences are ported to online channels. I think that the convergence of AI, IoT and ease of development will introduce an order of magnitude of new software-driven services to consumers over the next decade. These digital experiences will be constructed using modern application stacks and building blocks from developer-focused software providers.

For investors, we have seen that analysts and the markets have historically underestimated how persistent this growth can be. Present day stock valuations are driven by future expectations for revenue growth. If providers outperform expectations, that will generate upward pressure on stock prices and creates alpha for investors.

Bessemer called out this dynamic in their report. They provided examples of SaaS company historical values for estimated versus actual revenue growth in the years following the company’s IPO. See how long Salesforce outperformed as a good example. While this difference may not look significant, that compounding of 10-20% extra growth over several years has an enormous impact on total revenue at the end of the period.

Looking forward, this underestimation is persisting. As an example, Cloudflare revenue growth estimates for 2022 – 2023 anticipate growth in the low 30% range. Given Cloudflare’s TAM, small run rate and rapid product development cadence, I think they could deliver 40-50% annual growth for several years, continuing their fairly consistent revenue growth CAGR since 2017.

What About the Hyperscalers?

While the Hyperscalers offer many of the same services as the independent software providers, I don’t favor them as investments for a few reasons. The main one being that I think their high growth has largely played out as a consequence of scale. On the other hand, I think independent providers can thrive in their niche markets and beat the hyperscalers in many categories. Given the size of their respective TAMs and low revenue run rates, the independent providers have more room to run.

I often hear from investors that competition from the hyperscalers will starve out the independent providers. The argument is that if a hyperscaler wanted to, they could apply their vast financial resources to dominate any category. Yet, this still hasn’t happened in most cases. Year after year, the independents are able to win a substantial share of business and continue to grow their revenue. As it relates to competing with the hyperscalers, I think the leading independent providers have three primary advantages.

First, they are neutral. Customer engineering teams generally want to avoid lock-in with a single hyperscalers’ custom solutions where possible. These teams will gravitate towards multi-cloud deployments and neutral providers for resilience and flexibility. Lack of lock-in provides more leverage in contract negotiations. Finally, the versatility of multi-cloud prevents an application rewrite if the customers needs to move off of one hyperscaler, perhaps out of competitive concerns (often the case with AWS).

Second, extreme product focus allows the independents to more closely respond to the needs of their customers and iterate rapidly through release cycles. The independent software provider can work directly with the engineers and product managers utilizing their solution. This feedback isn’t obfuscated by layers of salespeople covering many product offerings. The engineering teams at the independent software providers are driven to release rapidly, as their output directly impacts the company’s performance. This differs from a product team within a hyperscaler, where a release announcement may be buried within a long list of other news.

Finally, the leading independent providers are magnets for talent. These individuals are seeking opportunities for greater financial upside and career growth. Because of their size, hyperscalers are unlikely to experience as much price appreciation in their stock. Also, organizations tend to be more static. Independent software providers can offer ambitious employees lucrative stock incentives and promotions into brand new teams.

The Builder Portfolio

Hopefully, this post has provided investors with reassurance that enterprise investment in new digital experiences will continue and that companies providing the software building blocks used by developers will benefit. I have tried to lay out a framework for evaluating the software providers and indicators that investors can watch for to determine which companies should maintain leadership in their respective categories.

As the leading software providers continue to invest in product development, they will extend their product offerings and grow their addressable market. This, coupled with secular tailwinds from digital experience investments, will allow them to maintain high levels of revenue growth. Investing in the companies that are likely to exceed future expectations for revenue growth will provide investors with a source of alpha.

For my personal portfolio, I maintain a list of the software building block companies that I currently favor. Below is a list of the publicly-traded companies that provide developer building blocks and perform favorably on the indicators that I have outlined. This is a result of addressing a large market, strong developer outreach, rapid product development cadence, hands-on leadership and potential for sustained outperformance. Given that these providers address segments of the developer toolkit, we can conceptualize the basket as a software builder’s portfolio.

The companies with a green circle are the ones that I am currently invested in, but I have owned all stocks shown in the past. I will likely cycle in and out of them at various points, as they experience stages of momentum and consolidation. A primary indicator for a surge in stock price is revenue growth acceleration, during which I will tend to lean into a stock. Over time, revenue growth will cycle through periods of acceleration and deceleration. Innovative companies can go through phases of growth as their product offerings align with market demand. I try to focus on the companies that are benefiting from the strongest alignment and execution at that point in time. In all cases, these companies are maintaining their underlying foundation of product expansion and developer centricity.

Regarding the valuation drawdown and market gyrations we have experienced thus far in 2021 for high growth software stocks, I am not surprised. Most of these companies appreciated 2-3x last year, so some price consolidation is expected (whatever you attribute as the reason). In my mind, the underlying revenue growth and market potential hasn’t changed. If anything, demand will be greater going forward. That will eventually work itself back into the stock price.

All of the companies I have circled delivered at least 50% revenue growth last quarter. I expect high revenue growth to continue – maybe not sustained at that level, but certainly above what analysts are modeling. For the others, as their revenue growth re-accelerates, I will likely re-open a position. I am not looking for companies that will double in price every year. A stock price CAGR of 30% a year will increase my portfolio by almost 4x over 5 years. Beating analyst estimates for revenue growth and profitability each year will provide an upward bias for the stock price. Companies that maintain the same level of revenue growth annually are usually able to maintain the same valuation multiple (putting aside one-time resets). In those cases, annual stock price growth correlates directly to revenue growth.

NOTE: This article does not represent investment advice and is solely the author’s opinion for managing his own investment portfolio. Readers are expected to perform their own due diligence before making investment decisions. Please see the Disclaimer for more detail.

excellent… which are the possible publicly traded option on blockchain companies that you have referenced.

Thanks for the feedback. I actually don’t have any pure-play blockchain companies that I am in a position to recommend at this point. I am sure there are some, but I haven’t researched them sufficiently to make a recommendation (perhaps a future direction for this blog). As mentioned in the article, there are several publicly-traded software providers that largely service the current Web2 infrastructure, which could expand their product suite to include offerings for the Web3 decentralized, blockchain-enabled ecosystem as that emerges. Probably the best positioned companies are those that provide services tied to a theme, like observability, communications, edge compute or content acceleration. Examples here would be Datadog, Twilio, Cloudflare, Fastly and DocuSign. Companies that might have more trouble pivoting to Web3 would be those tied to a particular open source project or technology. Examples here would be MongoDB, Elastic, Confluent, and various payment services.

Thank you for your amazing insight into SaaS companies! A lot of great information in this article!

Thanks for another great Article Peter.

Just something I was wondering when looking at your portfolio, what is your opinion on Snowflake? Assuming that you have concerns surrounding their valuation, do you have a price range where you’re comfortable to buy?

Thanks for the feedback. Snowflake is tough for me, as I think they have a great deal of potential. But I think this is a stock where valuation and entry point are important considerations. The challenge I have is projecting where the revenue growth rate will land over the next 2-3 years. While I think we can confidently estimate that it will double this year, I can’t reasonably project what growth will be in 2022 and 2023. I like to lean into a stock once I have a little more history with the company’s execution. This is partially why I stayed out of DDOG in 2019 and 2020, but feel comfortable with it now. As another example, I can confidently model that NET could grow revenue for 50% a year for several more years, given their past execution, TAM, product release cadence and smaller run rate.